All of us at Down Payment Assistance of Arizona would like to wish you a Merry Christmas and a Happy New Year! We would like to thank you for making 2018 a great year and for the privilege of helping you purchase or refinance your home. We hope that 2019 is a year full of […] READ MORE

The holidays are upon us and that means more packages arriving at your front doorstep. In 2017, it was reported that 74 percent of packages were stolen from the front porch during the day while the homeowner was at work. Technology advances can improve the security of your home. Adding a smart doorbell is not […] READ MORE

I get a water line insurance offer at a minimum of once a year. They tend to come in the mail and look like an “official” notice from your local water company saying something like: “Important Information Regarding Your Water Service Line. Response Requested Within 30 Days.” Many homeowners open the letter because the outside […] READ MORE

Each year, many people migrate from colder regions of the United States to spend the blistering cold months, somewhere warmer. In Arizona, snowbirds are as common as cacti, gorgeous sunsets and desert wildlife. If you live in a cold winter climate you can understand why there is such an appeal to being a snowbird. No […] READ MORE

How do you begin one of the hardest decisions in your life? I’m talking about becoming a first-time homebuyer. There is an overload of information both online and when you ask friends or family how to start the home buying process. Most people don’t see a lender before they start going to open houses and finding a […] READ MORE

When you ask, what you think is a simple question, “How long does it take to close on a mortgage?” You might expect a simple answer, but in truth, that simplicity you are seeking in an answer is nearly impossible to give. There are so many determining factors that you should know about. Closing time […] READ MORE

For a multitude of economic reasons, refinancing your mortgage loan could be the perfect solution to help you save a few pennies this year. Your savings will go well beyond just easing up on the monthly mortgage bill. We recognize that rates have gone up since this time last year; rates are still historically low. […] READ MORE

When you consider your home purchase, there is an unspoken rule that plants a seed that you should stay in your new home for at least five years. Otherwise, you’re probably going to take a hit financially, but like many things in life; the Five Year Rule is not a hard and fast one. It may […] READ MORE

Applying and obtaining a mortgage is an intricate process. There is a lot going on behind the scenes that you might not be aware of. Take One: The completion of the loan application. Take Two: Application sent to loan processing. Take Three: Application goes to the underwriting department. Sounds as easy as one, two, three, […] READ MORE

When it’s time to finance your home, you will discover that mortgage calculators are a great resource. We have all seen our fair share of mortgage calculators over the internet, once you start your search for the perfect home, mortgage calculator ads pop up, and there are many to choose from. But do you know […] READ MORE

There can be many reasons you might be thinking of moving soon. You could be considering relocating for work or have new neighbors that are a bit louder than you like, or you recognize it’s just time to downsize. Suggested Reading: The Home Plus Program in Arizona Here’s a look at four reasons why now […] READ MORE

You just closed on your first home. Congratulations! The excitement is unmistakable, and now you get to direct your attention to all the great stuff you need to fill this brand new home of yours. You feel like now is the time to sit back, put your feet up and stop worrying about your credit […] READ MORE

How does a commission-based income affect a mortgage? It’s more common than ever to have employees who do not fit the standard mortgage qualifying box. Employees are working remotely or spending half time in the office and half time working from home or working on strict commission. If you are good at your job, employers […] READ MORE

Applying for a mortgage is like going to school. Each year you enter the next grade, and the next and so on. While some students thrive, others struggle. Perhaps they do not understand the material or they were not given the tools that they needed to succeed. Just as every student is unique in their […] READ MORE

Congratulations, you have endured the loan approvals, the inspections, the negotiations, the walk-throughs and it’s closing time. Just as you made it through each step that brought you to this moment, you should be excited, you’re about to close on your new home. The closing is the final step in the process before you are […] READ MORE

Have you ever accidentally missed a due date on a bill? If you’re like most American’s you may have slipped and forgot to send in that payment; maybe you were on vacation, ill or overwhelmed with work. There are many reasons this mishap could have occurred. More than likely we expect to get charged a […] READ MORE

Your home may be the largest investment you will make. Keeping your home not only looking its best but performing maintenance and replacing items that may need upgrades are all a part of homeownership. If you do not have the necessary funds to maintain or make changes you might consider a home improvement loan. If […] READ MORE

Congratulations on saving up enough money for your down payment, that’s no small feat. Now you are ready to go out and find the perfect home to buy. But do you really know what you are looking for? First, consider the type of home you are looking for. Are you looking for a single-family home, […] READ MORE

Money talks when it comes to making an offer on a home. Sellers find cash offers appealing for a good number of reasons, they can close quickly, they don’t have to worry about the buyer’s financing falling through, and most cash buyers want the process to be completed as quickly as possible. Suggested Reading: Home […] READ MORE

When you’re buying a home there are tons of new terms and processes you’ll be learning as you go. More than likely one of those terms will be “closing costs” and you might think to yourself, “great, more money.” We know this is an exciting time, but it would be good to take a moment […] READ MORE

Owning a home can be costly, and any homeowner would be happy to save a few dollars anywhere we can. Buying or building a home that is energy-efficient can not only lower your bills but also increase the value of your home. Just how much your home will increase in value depends on a number of […] READ MORE

I saw a meme that poked fun at the changing seasons in Arizona, it asked the question, how can you tell it’s fall in Arizona? The changing of the license plate colors; of course that has to do with the influx of snowbirds to the area, but September in Arizona doesn’t feel that much different […] READ MORE

I’m in my mid-40’s and my circle of friends and I are finding ourselves in positions of having to navigate our aging parents’ refusal to grown old gracefully and their determination to keep the homes that they have paid off, or nearly paid off; that may or may not be working for them anymore. These […] READ MORE

Ready to buy your first home, but you don’t have enough of a down payment saved; no need to worry, you may be able to tap into your traditional IRA for down payment funds. Having a down payment is one of the biggest challenges for first-time homebuyers. Saving for the down payment is generally a difficult task, […] READ MORE

Do you have a 30-year mortgage? That’s over half of your working life! We know that the purchase of a home is a dream for pretty much everyone. But, taking on that massive debt can prevent you from retiring earlier, sending the kids to college, or taking that dream vacation. If your mortgage is putting […] READ MORE

Summer is nearing its end, believe it or not, and the little ones are either back to school, or gearing up to go back to school. If you have a couple of extra vacation days, why don’t you consider a couple of DIY projects and enjoy a mini staycation. I’m not saying that binge-watching some […] READ MORE

With home prices high and listings low, potential buyers are frustrated. There is plenty of demand, but it is not translating into home sales and many first-time homebuyers are being priced out of the market. Mortgage application volume fell two percent for the week, according to the Mortgage Bankers Association’s seasonally adjusted report. Last week’s decline […] READ MORE

Bankruptcy can be a great tool to use to help you get back on your feet financially. However, going through a bankruptcy can be a very traumatic event, both emotionally and financially. Your confidence in your ability to function financially may have been shaken and you may be wondering if there is any hope for […] READ MORE

Are you looking for your perfect match? Most people are, but you would be amazed at how many people don’t take the time to find the right mortgage lender. When you buy a home, getting the right mortgage loan is just as important as the right house and finding a mortgage lender involves more than […] READ MORE

We understand that there’s a lot to learn before embarking on your home buying experience. When you finally make the decision to buy, you want to know that the home is safe and that there are no major defects. This applies to both new construction homes and older homes alike. This is why a professional […] READ MORE

So, what’s your number? No, we’re not talking about your phone number, we’re talking about those three digits that have a pretty big impact on most areas of your life; your credit score! That’s not saying that having a high credit score won’t get you a date, but this isn’t a dating site. Your credit […] READ MORE

When temperatures range from 110-116 degrees, keeping your home cool while trying not to break the bank seems like a futile battle. Keeping your home cool during the warm months can take a big toll on your finances. Cooling costs can account for more than half of your electric bill. Many new homeowners and house hunters […] READ MORE

I’m sure you’ve heard sage advice that every credit inquiry will impact your score negatively. While there is some truth to this, your credit score is affected by a number of reasons. In part; yes your credit score is affected by the number of inquiries, however, if you are looking for a mortgage or auto […] READ MORE

So you want to buy a home? What do you need to know before you get keys? As you shop for your dream home, key questions to ask yourself very early in your search include: Are my credit reports accurate, up-to-date and correct? What information and documents will I need to gather to apply to […] READ MORE

Qualifying for a mortgage is likely going to be one the biggest financial hurdles in your lifetime. If you know that your credit is less than perfect, or if you have already met with a lender and found out that you don’t meet their requirements to be approved for a mortgage, then finding someone to co-sign […] READ MORE

As consumers, we are always (or should be) looking for ways to save a dime. Many ways American families save money is to shop at a warehouse store. Costco is one of the popular warehouse stores where you can buy nearly all of your essentials if you’re willing to buy a large quantity. If you […] READ MORE

If you recently submitted to have your credit checked for a mortgage loan, specifically to refinance, you might have noticed you received a call or two from a “mortgage professional” looking to help you. You were falling victim to a trigger lead. What Is a Trigger Lead? Similar to when you make a general search […] READ MORE

Private Mortgage Insurance (PMI) is a mandatory insurance policy for conventional loans which insures a lender against loss in the event that the homeowner stops making payments on a mortgage loan. Mortgage insurance can help people become homeowners who might not otherwise qualify if they don’t have 20% to put down on a home. When Is […] READ MORE

In just the first couple of months of the year, about 1.4 million borrowers lost the interest rate incentive to refinance according to an analysis from real estate data provider Black Knight. In the opening weeks of 2018 interest rates have surged, making it more expensive to buy and own a home. The benchmark for […] READ MORE

Everyone wants to buy a home that they love AND that has great features for resale. The challenge for home buyers is to find that perfect balance between what’s practical and what’s charming without getting too emotionally attached to anyone home. People make decisions on both sides of their brains to buy a house — […] READ MORE

Homeownership is one of the best feelings you can have as an adult. It brings you a sense of accomplishment, pride and fulfillment. But with homeownership comes much more responsibility and stress; making mortgage payments, keeping up with repairs, dealing with higher utility bills to name a few. By no means is homeownership cheap. I […] READ MORE

As a consumerist society, we try to counteract our spending with saving as much money as we can. If you’ve ever listened to Dave Ramsey, he says one of the ways to financial freedom is to eliminate all debt by getting rid of all of your credit cards. This works for some individuals and yet […] READ MORE

Are you setting financial goals for the future? Are you building a wealth system that will include college savings account’s for your children or contributing to a 401K? Most Americans will be happy to share that their personal financial goals are to be able to provide for their families as much as they can, or […] READ MORE

Mortgage lenders require homeowners to carry homeowners insurance. Just as most states require car owners to have insurance. Not only is it for your own protection, but one of the big ones for the lender is that in the case of a catastrophe, your lender will want your home rebuilt. With proper coverages through your […] READ MORE

We might all have heard the saying, “The more money you make, the more money you spend.” Did you also know that the more money you save, the more addictive saving money becomes? Just like exercising, it’s hard to find the motivation to go to the gym, but once you start seeing results you want to […] READ MORE

Barbara Corcoran is not only a real estate guru and Shark Tank star but a real-life inspiration when it comes to how to succeed in business. She often tells the story of how she turned $1000 into a billion-dollar business. It’s fair to say that taking a few lessons from this down-to-earth entrepreneur can help […] READ MORE

Are you thinking about buying a home in 2018? You’re not alone. Let’s take a look at where the housing market stands today and what to look for this year. Home Prices on the Rise It’s quite likely that home prices will continue to rise gradually in 2018. According to the National Case-Shiller Index, the […] READ MORE

On Thursday, the Federal Housing Administration (FHA) that almost every area in the U.S. will see FHA loan limits increase in 2018. In addition, the Department of Housing and Urban Development (HUD) announced it was also boosting limits for those loans in more than 3,000 counties. The increase in new loan limits will take effect for FHA cases […] READ MORE

There is a little chill in the air and beyond wearing an extra fluffy sweater or an extra pair of sox, some people can’t shake the chill. Other than heating your entire home, when one person can’t get warm what options do you have? There is a long-discussed debate whether the use of a space heater […] READ MORE

We live in a world full of options. We are a society who wants immediate gratification. The flipside is how we sort through all of the options so we can make an informed decision in the least amount of time possible and get the best deal while making it. First off, you will want to […] READ MORE

Did you spend a little more than you budgeted on holiday presents this year? With so many “Door Buster” deals and savings, retailers trick you into thinking the more you spend, the more you save, but we know that’s not the reality. According to data released by the Federal Reserve, U.S. credit card debt has […] READ MORE

Happy New Year…I typically do not make New Year’s resolutions, but many American’s do. If you resolved to buy a new home in 2018, there are plenty of other preparations that would-be homebuyers can make to put homeownership within reach for the New Year. If your resolution was to purchase a home there is more than […] READ MORE

The most fortunate are those who have a wonderful capacity to appreciate again and again, freshly and naively, the basic goods of life, with awe, pleasure, wonder and even ecstasy. ABRAHAM MASLOW With the holidays upon us, it is so very easy to get caught up in finding the perfect gift for family members or […] READ MORE

We are sincerely honored you take time out of your day to be here. Our team is very excited about the holiday season and the upcoming New Year. We look forward to continuing to assist our clients with all of their mortgage needs. Please contact us today with any questions you might have. We are […] READ MORE

The last thing the majority of Arizona needs is to save is daylight. On a July day in Phoenix or Tucson, when the high is 114 degrees, the faster the sun goes down, the better. Daylight Saving Time in the United States is the practice of setting the clock forward by one hour during the […] READ MORE

Unless you are one of the 23 percent of the population (as of January 2017) lucky enough to pay cash for a residential home, you are at the mercy of the lenders to appraise your next home at the value you need in order to obtain a mortgage. A home appraisal is a process the […] READ MORE

Ask any real estate agent and they might tell you that the proverbial “now” is always the right time to buy. They might be right and not just trying to sell you a home for their own personal income they receive on the sale of a home. There are facts to prove that now, really […] READ MORE

The Republican leadership in the House released its long-awaited bill to reform the nation’s tax code, the “Tax Cuts and Jobs Act.” There is a lengthy bill that will be exposed and litigated in the next coming days. Most GOP members seem to agree after review of the many details that are tucked into the […] READ MORE

Firefighters continue to battle the 22 large wildfires that continue to burn through seven counties in California, including the famed wine-producing areas of Napa and Sonoma. Reports say about 3,500 homes and buildings have been incinerated by the blazes, which have ravaged about 170,000 acres, mostly in Northern California and the causes of the fires have […] READ MORE

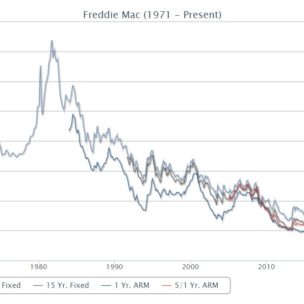

On Thursday, Freddie Mac reported that the average rate on 30-year, fixed-rate mortgage rose to 3.94 percent from 3.88 percent last week, compared to the same time last year when the benchmark rate was 3.47 percent. This means that the 30-year fixed-rate increased to its highest point in the past three months, according to Freddie Mac’s latest Primary […] READ MORE

I don’t know about you, but when I start the process of buying anything of value, something I want to last, whether it’s a new pair of hiking shoes or a new mattress I start by doing my research. When it comes to bigger items along with my research, I add reviews and opinions of […] READ MORE

The recent breach of personal consumer information from the national credit bureau Equifax could affect home buyers significantly. Homebuyers and mortgage applications have a significant amount of information on file at the bureaus that could potentially turn into trouble for some in the future. Equifax says that as many as 143 million consumers’ personal data […] READ MORE

The recent breach of personal consumer information from the national credit bureau Equifax could affect home buyers significantly. Homebuyers and mortgage applications have a significant amount of information on file at the bureaus that could potentially turn into trouble for some in the future. Equifax says that as many as 143 million consumers’ personal data may have […] READ MORE

A reverse mortgage can be a challenge to explain or understand, even for people who have plenty of financial experience. What Is a Reverse Mortgage? There are many factors that play part in a reverse mortgage, but at its core, it is a home equity loan that is designed to help borrowers tap into the equity in […] READ MORE

In the midst of a natural disaster paying your mortgage is not top of mind. Those who are fighting to survive in flood stricken areas in the aftermath of Hurricane Harvey are more concerned with knowing if their homes will be habitable once flood waters recede or if their homes will be total losses. And […] READ MORE

Once you apply for a home loan, your mortgage application is organized by a loan processor and then sent to a loan underwriter. The underwriter determines if you qualify for a mortgage. Going through the mortgage underwriting process sounds scary. The thought of someone (a mortgage underwriter) taking a deep dive into your finances can […] READ MORE

When you start the home buying process you look at (on average) between 7-14 homes before deciding on that special home; before you’ve chosen and a deal is made between buyer and seller it’s time to work with a mortgage loan officer. However, if you’re like many homebuyers, you’re not really sure where to start […] READ MORE

There is an equally long list of pros and cons to being self-employed. On the plus side, there are things like setting your own hours and working on projects you really enjoy. On the downside though, there is the up-and-down income cycle and managing your own taxes, health insurance and retirement accounts. In addition, the […] READ MORE

Are you familiar with the metaphor, “It’s all Greek to me?” Referenced in Shakespeare’s play Julius Caesar, its meaning is used to express something that is not understandable. I find this true when trying to understand mortgages! It’s all Greek to me, yet it is a crucial part of the home buying process and a […] READ MORE

If you’re looking to enter the housing market, it may have just become easier for you to acquire a loan. Home mortgages are typically based on Fair Isaac Corp. (FICO) credit scores. FICO scores are given to individuals based on a number of factors like payment history and the number of credit accounts and more. […] READ MORE

When buying a new home have you been shocked at the cost of home insurance and wondered why the premium is so costly? If you’ve never owned a home before, you only assume that it has nothing to do with your past, but here comes the surprise, it can have everything to do with the […] READ MORE

No matter how great a home looks at first glance, a host of problems could be hiding right under your very eyes, which is why any potential buyer will want to scrutinize the property disclosure statements. According to legalmatch.com, “The Seller Property Disclosure Statement is a checklist designed to help sellers disclose to buyers any […] READ MORE

Has your summer been full of vacations and weekend getaways? Have you been sharing your adventures with friends and family on social media? Sharing too much on social media could leave you open to burglary and a possible loss of insurance coverage. When your posts tell “most everyone” your location and dates for when you’re […] READ MORE

When a homebuyer is looking to make a purchase, all kinds of new terminology can come into play. There is closing costs, discount points, and PMI just to name a few. What is PMI? Private mortgage insurance, also called PMI, is a type of mortgage insurance which you are required to pay for if you […] READ MORE

Last week’s Freddie Mac Primary Mortgage Market Survey revealed that interest rates for a 30-year fixed rate mortgage have fallen to their lowest mark this year, the lowest level thus far in 2017at 3.88%. If you’re home shopping, this is great news for homebuyers looking to purchase and homeowners looking to refinance. Let’s take a […] READ MORE

If you’re tired of throwing money out the window on rent, you might be considering purchasing a home. So, how much money do you really need to buy a house? We have talked about down payment funds and even zero down payment options, but what about income? How much do you really need to make […] READ MORE

The Fourth of July symbolizes the day that the United States declared itself an independent nation. The Fourth of July is a day to celebrate our Declaration of Independence. The Declaration of Independence was adopted by the Continental Congress in 1776 and devised by Thomas Jefferson. July 4th symbolizes the birth of our great country. Many […] READ MORE

When shopping for a new home do you shop for a small home or a large home? There are pros and cons to each. When it comes to real estate, you should first remember the old adage, “location, location, location.” That is still a more important factor than size. But, if you are considering homes […] READ MORE

Inventory shortages will be a big concern for buyers going into home shopping season. There’s a lot of demand from homebuyers, and a low supply of homes available to buy to soak it up. In fact, there are 2.6 percent fewer homes for sale this year than last year and what is for sale is […] READ MORE

Have you ever thought what if I won the lottery? Or what if I had a million dollars? I’m sure we’ve all thought about what we might do if we had a landfall of money; we might take an extravagant vacation, buy a new car, pay off outstanding debt, but did we also think we […] READ MORE

Whether you bought a house five years ago or 15 years ago you may be ready to refinance your mortgage. Refinancing has its perks. First you should consider why you would like to refinance. Refinancing your home mortgage loan can be very beneficial for a lot of homeowners. Some of the reasons you might consider […] READ MORE

How many times have you seemingly lost an item only to later find it in a pile of clutter afterwards? You’re not alone, the average household has over 300,000 items in it? I am a very organized individual, but I remember someone once saying to me, that just because all of my containers were organized […] READ MORE

Over the past several years we have seen an increasing trend in what enthusiasts are calling the Tiny House Movement. Folks are giving up their 2,000 to 5,000 sq. ft. homes and minimizing their lifestyles to fit into 500 sq. ft. homes or smaller. The idea is to give up paying on a mortgage for […] READ MORE

Looking to hold onto the proceeds from the sale of an investment, but agree to pay the tax later? That’s what real estate investors do when they defer taxes with a 1031 Exchange. What Is a 1031 Exchange? According to 1031.org, “A 1031 exchange is a method of deferring the tax on capital gains until […] READ MORE

So you’ve decided to buy a new house. Maybe you’re moving to a new city, or maybe just a new part of town. Maybe you’ve come to a crossroads in your life and decided it’s time to take the homeownership leap. Before you even think about shopping around, you have to decide what means the […] READ MORE

I remember when I was buying my first home and the mortgage loan officer walked into the office with a stack of papers about five inches high. My initial thought was; do I have to sign each one of those documents? Back then (yes, I realize I might be giving my age away here) the […] READ MORE

Real estate transactions are public record, accessible to anyone wanting information on a parcel. Available information includes value, sales history, square footage, improvements and ownership. The county recorder and the county tax assessor’s offices maintain real estate databases. The county recorder’s database includes all recorded transactions, such as mortgages and other liens, while the tax […] READ MORE

Federal Housing Administration mortgage delinquencies jumped in the fourth quarter for the first time since 2006, the Mortgage Bankers Association reported Wednesday. The FHA insures low down-payment loans and is a favorite among first-time homebuyers. The FHA insures loans and does not lend money. It requires just 3.5 percent for down payment, plus an upfront […] READ MORE

Congratulations on your decision to buy a house, it’s a big one. When you’re looking for a loan officer, you should look for several things to make sure you get the best. Finding the right loan officer is not a task that should be taken lightly. You will be relying on this person for financial […] READ MORE

Bouncing back from bankruptcy or foreclosure takes time. It is possible, but long before you begin shopping for a home you have to work hard to boost your credit profile and get a good handle on your mortgage options. It does go without saying that bankruptcy and foreclosure can take a serious toll on your […] READ MORE

Get ready there is a new group of home buyers about to hit real estate markets all across the nation; they are called the “Boomerang Buyers.” Over 7 million families lost their homes to foreclosure between 2007 and 2014 during the Great Recession. An additional 2.3 million sold their homes via short sale or selling […] READ MORE

Smart Gadgets for the Home Technology is really astounding. Imagine explaining to your grandparents that now there is a robot that can mow the lawn (Robomow RS622) or a scale that will make sure your baking is done to perfection every time (Perfect Bake Pro)? They might think you’re talking about an episode of the […] READ MORE

Getting pre-approved for a mortgage loan is possibly one of the best things you can do to help ensure you get the best shot at getting the home you want. First things first; you’ll need to shop for a lender. You’re going to disclose a lot of personal financial information to your lender and you […] READ MORE

Your family is growing, your once bachelor pad, turned honeymoon suite just isn’t cutting it anymore when your wife tells you the wonderful news that you’re expecting your first child. The excitement of starting a family leads you to rent a home, still not quite ready financially to buy, but ready to make a larger […] READ MORE

The biggest factor for 2017 is Donald Trump. Bringing business back to the US may come with a big price — a high dollar and strong inflation. Other major factors are the rising influence of millennials to shifting trends in home prices and housing inventory, here’s a look at the top housing market trends for […] READ MORE

One can’t pick up a newspaper or watch a news show on TV without seeing the news filled with the new administration’s moves. On Friday U.S. President Donald Trump ordered reviews of major banking rules that were put in place after the 2008 financial crisis, drawing fire from Democrats who said his order lacked substance […] READ MORE

We are taught from an early age to protect our personal belongings. We keep our bicycles locked and protected; we lock our diaries and take good care of our favorite toys. As we age, the things we protect becomes more important as the items are likely more valuable. When you are in the market for […] READ MORE

Checkups are a good thing. We get our cars checked up, we get our bodies checked up with physicals, and we get out teeth checked up with cleanings. Why not checkup your mortgage? If you haven’t thought of getting a mortgage checkup you may be missing out on opportunities to save yourself money. Just like […] READ MORE

Technology has shifted the home buying experience into the hands of the consumer. Tools like smartphones, tablets, laptops or desktop computers have made buying a home vastly more transparent allowing you access to information at the tip of your finger. Even a few short years ago, the “privileged” information used to be held by lenders […] READ MORE

The Hidden Truths behind Solar Panels and Your Mortgage There are many things we think of when we hear solar-powered energy; cost savings and green living are among the first. For the true money conscious you might think tax credits, federal incentives, additional income and an increase to the value of your home. All of […] READ MORE

President Trump has made his very first executive action. The action was to block an Obama administration order that would have reduced the cost of mortgages for millions of home buyers. Following up on an article from last week where we told you about a mortgage-fee reduction the Obama administration announced January 9 and was supposed to go […] READ MORE

The VA Loan program is the most powerful home loan program on the market and has been around for almost 75 years. The VA loan is a mortgage loan in the United States guaranteed by the U.S. Department of Veterans Affairs (VA). The VA Loan is available to veterans, active duty, reservists and National Guard members, […] READ MORE

No one ever expects to file an insurance claim, just like when you purchase the extended warranty on the new 60-inch Smart television you just purchased. You hope you don’t need it, but just in case, you think spending the extra couple of dollars might be worth it in the long run. Homeowners insurance might […] READ MORE

Not too long ago when I was house hunting it seemed like I was getting outbid and losing every offer I made to an all-cash buyer. Here I was trying to purchase my first home, I saved and saved up my down payment and was getting discouraged by individuals who would come in and make […] READ MORE

Filing taxes is never what most rational folks would call “fun.” But if you have a mortgage, you could still have something to smile about. You could be getting a federal tax break in the form of a mortgage interest deduction. The great benefit of the mortgage interest deduction is that it allows you to […] READ MORE

It’s a wonderfully fun time of year when family and friends come together, however, it’s also a time when thieves creep and crawl about waiting for you to get a little side-tracked in hopes of you forgetting to lock the door or leave an opening that they can take advantage of. If you are planning on […] READ MORE

Tis’ the season to be jolly, eat holiday cookies, spend time with family and friends and add holiday décor to our homes with lights, trees, candles, and ornaments galore. What we sometimes fail to think about is that many of these decorations can be extreme fire hazards or choking hazards for children and pets. The […] READ MORE

When you meet your mortgage lender for the first time, it might feel as if you are meeting your future mother or father in-law with all of the questions getting thrown at you. By the time you step out of the office, you will likely feel like you have zero secrets left to share. Many […] READ MORE

Today we are asking the age-old question of whether it is cheaper to own than rent a property the honest answer to the question is yes and no. There are several factors that weigh in when making the decision to own or rent. How long do you plan to live in your current city or […] READ MORE

When you are seeking out a loan for any reason, having a high credit score equals lower interest rates. If you are seeking a mortgage loan, a high credit score allows you lower mortgage interest rates, if you apply for a credit card, your limit increases and something you may not have thought about, when […] READ MORE

Down Payment Assistance (DPA) programs are designed to make new homes affordable for low to middle income buyers. These mortgage programs can be used whether you are a first time buyer or fifth time buyer (unless there is a state specific program that sets its own rules). More and more we are seeing that these […] READ MORE

Do you watch the HGTV sensation Property Brothers? The concept is two brothers, one a realtor and the other a general contractor take a couple who already has an established budget to see their ideal dream home, which turns out to be about two or three hundred thousand dollars over their budget. Then the general […] READ MORE

Today we are talking about the delicate balance of keeping debt or paying off debt prior to applying for a mortgage. It makes sense that buyers would want to increase their credit score before applying for a mortgage. One would think if they paid off all of their debt and then applied for their mortgage […] READ MORE

Have you ever played Craps? You roll the dice and you hope and pray that you get the numbers you need to win big. If you don’t, well, then you lose big. The same could be said about your credit score, three tiny little digits that can affect your life in many ways. It’s not […] READ MORE

Consumers are going online more than ever to look for information to support their buying decisions. We read reviews, look up brand-specific information, go to Facebook Groups for recommendations, check out trends on Twitter and the list goes on and on. Home purchasing is also being influenced by social media, both from the standpoint of the […] READ MORE

Are you familiar with one of the largest home loans in the U.S.? The USDA (United States Department of Agriculture) Home Loan. The USDA is an agency within Rural Development. The USDA Home Loan is backed by the government and widely available. These loans were created to help low and moderate-income families buy a home with no down payment at a […] READ MORE

Understanding the difference between the varying home loans can help you avoid unnecessary time and expenses when you are trying to qualify for a mortgage. Two of the most commonly used loans are FHA and conventional mortgages. There is a wide range of home loans to meet seemingly every circumstance, the challenge is choosing the right loan. […] READ MORE

Have you wondered about the pros and cons of Down Payment Assistance (DPA) programs? DPA’s are intended to make new homes affordable for low to middle-income buyers (some income limits are quite high now extending to $92,984 or higher). I know as a first-time homebuyer I didn’t have a 20% down payment saved up. There are a variety of programs […] READ MORE

Do you have a desire to have a small piece of the American dream? Does that dream include owning your own home? Are you just not sure how to get there; how to find the necessary financing to help you achieve your goal? There is good news, 100% loans do exist, and there’s a good chance […] READ MORE

What does Survivor have to do with your credit score? The reality television show is in its 33rd season. The concept, take 20 strangers, place them in a jungle and let them, “Outwit, Outplay and Outlast” one another. This season, the theme is Millennials vs. Gen X. Oddly, the theme and generational game strategies and […] READ MORE

A down payment is a big part of financing your home purchase. If you’ve not allowed yourself to consider buying a home because you don’t have 20% to put down, do you give up on your dream of home-ownership? It’s harder and harder to get easily approved credit, but potential homebuyers can still get mortgages with […] READ MORE

Have you ever felt like home is where the 30 year fixed rate mortgage is? When was the last time you were considering buying a new car? Maybe you knew that you wanted a gray SUV with a sunroof. Did you go online and research what makes and models were available? Did you then follow-up […] READ MORE

The housing market is no stranger to the ebbs and flows that create supply and demand. This is a conundrum in highly sought-after areas where there is an ever-increasing limited supply, which only increases demand. In this scenario, homebuyers often find themselves bidding against each other to pay more for homes. According to The National Association of Realtors, […] READ MORE

Buying your first home is both an exciting time and a fearful time. Purchasing a home is a significant milestone in many people’s lifetime. It’s unfortunate that many of life’s most momentous occasions are both the best of times and the worst of times. Because while house hunting for the first time can be exciting […] READ MORE

During the first presidential debate of 2016, Republican nominee Donald Trump used the platform as a way to redouble back his attack on the Federal Reserve and its chairwoman, Janet Yellen, accusing the central bank of “doing political things”. (1) Trump said, “We have a Fed that’s doing political things…by keeping the interest rates at this […] READ MORE

I heard a joke that said, “We can pay off our past and save for the future, as long as we avoid the present.” There possibly couldn’t be a more true statement. We are a credit-dependent culture. We work our entire lives with expectations being drilled into our heads that we need formal education, or […] READ MORE

Did you know that 87% of U.S. homes qualify for down payment assistance? For some, the process of learning how to qualify for a down payment is downright frustrating and confusing. Please continue reading as we help you understand the in’s and out’s of how to qualify for a down payment assistance program. If we liken […] READ MORE

If you are currently looking at Arizona homes for sale, but are not sure that you have the up front cash saved up, this new down payment assistance program may be the answer for you! The Pathway to Purchase loan program provides down payment assistance to qualified homebuyers purchasing a primary residence in 17 targeted Arizona cities. […] READ MORE