When you are seeking out a loan for any reason, having a high credit score equals lower interest rates. If you are seeking a mortgage loan, a high credit score allows you lower mortgage interest rates, if you apply for a credit card, your limit increases and something you may not have thought about, when researching insurance, the higher your credit rating the lower insurance rates.

If you think increasing your credit score is impossible, think again.

We can all use a few tips on how to improve our credit scores. Here are a few to get you moving in the right direction.

*The credit bureaus use the information in your credit history to calculate 3-digit credit score that represents your creditworthiness. The FICO credit score is the most common credit score. The credit score ranges from 300 to 850.

*www.creditsesame.com

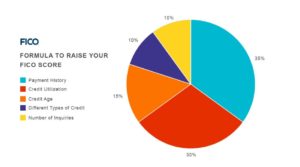

FICO credit scores are based on these factors, in the noted proportions:

The number of credit discrepancies is astonishing; one in five consumers find errors on their credit reports. You are allowed to, and highly encouraged to check your credit for free each year on one of the no-cost credit check sites like AnnualCreditReport.com.

It’s never fun when you find surprised on your credit report, but if you stay ahead of the game and correct errors on your report, you can improve your credit score.

Pay Your Bills on Time Every Time

Pay Your Bills on Time Every TimeIf you want to take the fast lane to good credit, pay your bills on time. This simple task is a huge contributor to a rising credit score.

By keeping low (or no) balances on your credit cars and other lines of revolving credit you may have a positive impact on your credit score.

Most lenders will tell you that the rule of thumb is to try and keep the amount of debt you owe below 30%. This may not always be financially feasible, but if you can’t keep a zero balance by paying off your credit card debt each month, try to increase the frequency of your payments.

Although this tactic may sound counter-intuitive, asking an issuer to up the credit limit on your current credit card could help put you under that 30% credit utilization rate — especially if you’re just going over it.

Changes that could scare your card issuer but not necessarily dent your credit score could be, taking out cash advances, or even using your cards for business use. Some of these red flags have the potential to indicate current or future money stress.

If you’ve taken all the necessary steps listed above and are not seeing an immediate change in your score, the best thing you can do is have a little patience; time and effort is the simplest way to solve credit problems.

People do not realize that negative information will typically take about seven years to “age off” of your report. On the other side of the spectrum, individuals with no credit need time to establish their credit history.

The best ways to keep your credit score intact and improve your score is to do whatever it takes and as long as it takes to get you in a good financial position.

Now that you’re taking all of the necessary steps to improve your credit score, you might also be looking for ways to make your down payment easier to handle.

One of many amazing down payment assistance programs here in Arizona that I’d suggest taking a look at is the Pathway to Purchase program.

The Certo Team

55 N. Arizona Place

Suite #103

Chandler, AZ 85225

602-429-6789