Last week’s Freddie Mac Primary Mortgage Market Survey revealed that interest rates for a 30-year fixed rate mortgage have fallen to their lowest mark this year, the lowest level thus far in 2017at 3.88%.

If you’re home shopping, this is great news for homebuyers looking to purchase and homeowners looking to refinance.

Let’s take a look at what the Freddie Mac Primary Mortgage Market Survey is and how it works.

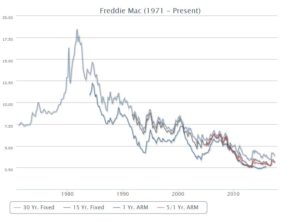

Created in 1971, the Freddie Mac Primary Mortgage Market Survey® (PMMS®) has evolved into the most representative and reliable source for rates on conventional mortgage products.

Created in 1971, the Freddie Mac Primary Mortgage Market Survey® (PMMS®) has evolved into the most representative and reliable source for rates on conventional mortgage products.

Each week, Freddie Mac surveys approximately 125 lenders where 25 lenders are selected from each of the Freddie Mac’s five regions. Freddie Mac’s 5 regions are:

*Based on information provided by FreddieMac.com

Northeast: NY, NJ, PA, DE, MD, DC, VA, WV, ME, NH, VT, MA, RI, CT

Southeast: NC, SC, TN, KY, GA, AL, FL, MS, PR, VI

North Central: OH, IN, IL, MI, WI, MN, IA, ND, SD

Southwest: TX, LA, NM, OK, AR, MO, KS, CO, NE, WY

West: CA, AZ, NV, OR, WA, UT, ID, MT, HI, AK, GU

The lenders are a mix of thrifts, credit unions, commercial banks and mortgage lending companies, which turns out to be proportional to the level of mortgage business that each type commands nationwide.

The lenders are surveyed on the rates and points for their most popular 30-year fixed-rate, 15-year fixed-rate and 5/1 hybrid amortizing adjustable-rate mortgage products.

The survey is based on first-lien prime conventional conforming home purchase mortgages with a loan-to-value of 80 percent. According to Freddie Mac, “The adjustable-rate mortgage (ARM) products are indexed to U.S. Treasury yields and lenders are asked for both the initial coupon rate and points, as well as, the margin on the ARM products.”

The rates are published weekly on Thursdays by Freddie Mac on its PMMS webpage. The rates are also published by the Federal Reserve Board as part of their Selected Interest Rates (Weekly) – H.15 publication under rates for Conventional mortgages. It is also available on Bloomberg through NMCMFUS <INDEX>. The NMCMFUS series is the weekly PMMS rates.

The PMMS rates are meant to be used as a guide to give users a general sense of what to expect when shopping for a mortgage. We encourage shoppers to contact their loan officer to get the current rates as rates offered by lenders may be different based on the circumstances of your loan scenario. Other differences could also cause a rate to be different like, regional differences or market expectations.

This information is important because the rate you secure greatly impacts your monthly mortgage payment and the amount you will ultimately pay for your home.

The Certo Team

55 N. Arizona Place Suite #103

Chandler, AZ 85225

602-429-6789